Referral links for MAX referral Welcome bonuses:

150k AMEX Platinum: https://americanexpress.com/en-us/referral/JAIMEUNGnF?XL=MNMNS

90k AMEX Gold: https://americanexpress.com/en-us/referral/gold-card?ref=JAIMEUCYzp&XL=MNMNS

Bilt: https://bilt.page/r/0TAI-PZ9N

Capital One Venture X: Coming Soon, I don’t have one so I need to find someone

June 16, 2025 – I am updating this SOON. Main big things coming are:

- Churn game – how to play and keep an 800+ credit score

- AMEX Plat + Gold + Bilt + Venture X – Super Combo

- Business Gold

- …and more.

Stay tuned for a huge 2025 refresh with new cards and hacks. Feel free to read on though and come back next week for more!

——

Some quick highlights from this year, I found flights in April (Sakura / Cherry Blossom / Hanami season) from Europe to Japan for 22k Virgin points + ~$200 USD which is roughly equivalent to a ~$350 USD direct nonstop flight to Japan! It was a great surprise at the end of 3 weeks in Europe to stop by Japan for a week and a half “on the way back home”.

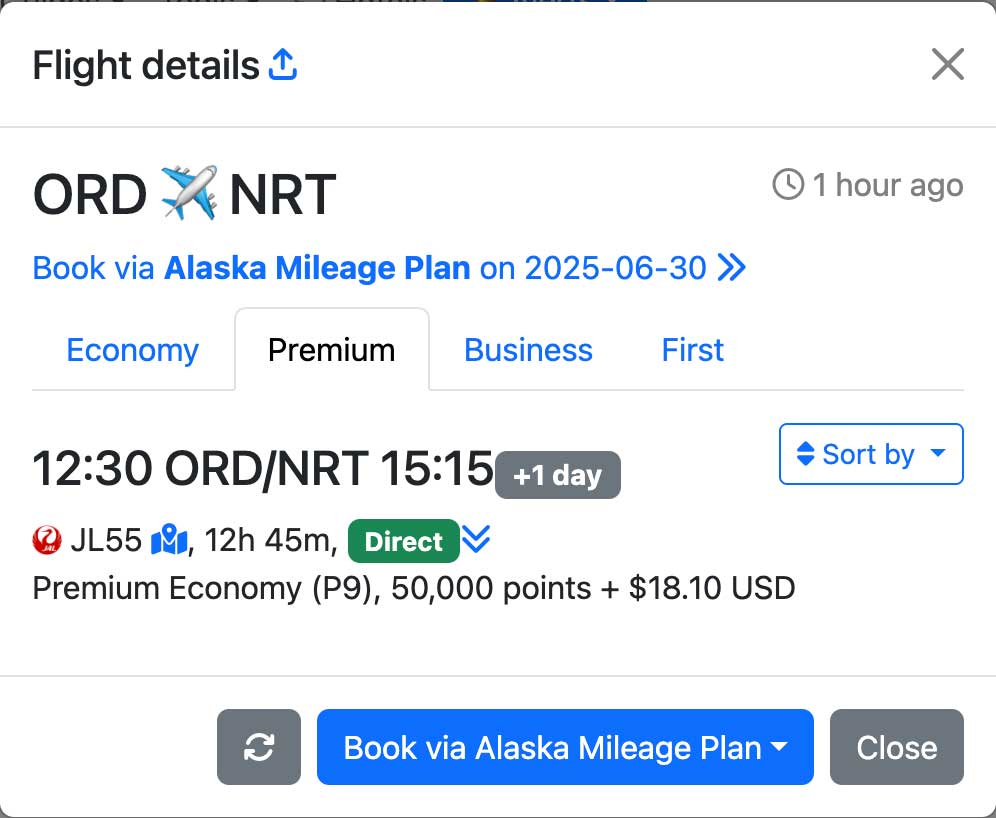

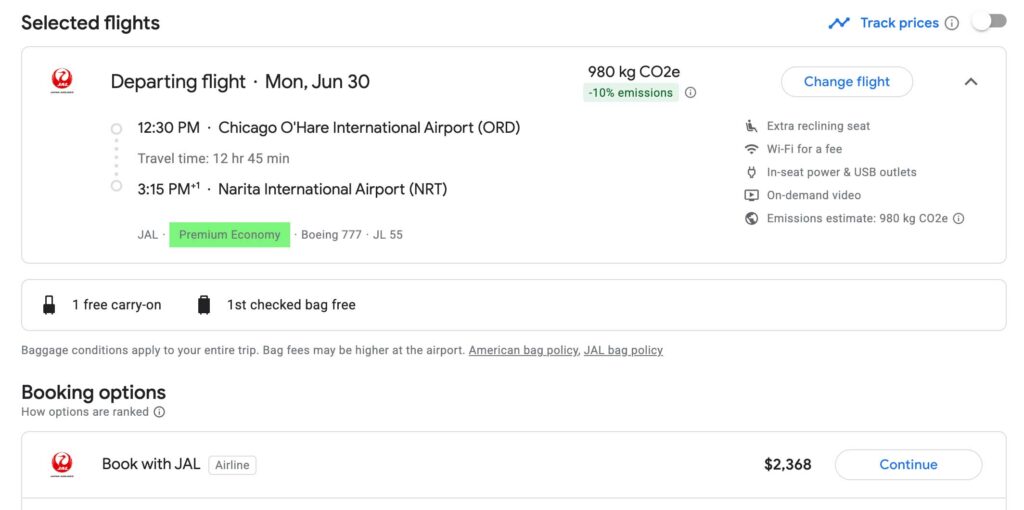

I also found nonstop flights in Premium Class on a Premium Japanese airline (Japan Airlines) for June, which I booked, for 50k points + $18.10 USD. This flight is equivalent to $2,368 USD per seat at the time of writing this! I then later upgraded to business class for an extra 25k (and then later switched over to ANA First Class for an extra ~10k , which I’m so excited to fly tomorrow!

———–

Let me start by saying this:

The goal of this guide is to help my friends save thousands on travel and get tens of thousands of travel credit a year, which for the most part, should enable them to travel more than they do now, and ideally, with me!

If this guide is helpful to you, you can thank me by:

– Using my referral links. Note: When I max out my referral bonus, I’ll put in my friends’ referral links so they can earn points. Send me your link if you sign up!

– Traveling with me!

– I didn’t encourage sharing previously, but now you can share it with some friends if you want.

Lastly, I want to show you very quickly just how powerful this is by giving a single example of how it works:

I pay my rent with my Bilt card. It’s ~$2500. I get 2,500 points for it. Let’s say I went to 2-3 restaurants and got an extra 500 points for a total of 3,000 points. I use the 100% transfer bonus to AeroPlan (Air Canada). I now have 6,000 points there. I use it to book a 6,000 points flight on United from Chicago to Vail (and pay the ~$35 tax). That exact same flight was ~$786 one-way if I paid cash for it.

If I had just paid my rent from my bank account I would get nothing for it. If I paid with my Bilt card and then the easy and regular cash back option most people opt for, I would have gotten $30 back for the 3,000 points. If I had used it to book travel directly, I could have maybe gotten ~$45 for it through the portal (also something people do because they think that’s how travel cards work, giving you ~50% extra value). Instead I used a transfer partner to multiply it, and used a search engine to find an optimal deal and get the most value for my points. Subtracting the ~$35 tax would leave about ~$750, which means instead of $25 or ~$35, I could get $750 that month for paying my rent and eating out a couple of times. This is an extreme example, but the much more common way I’ve used it is 5,000 points + $5 for $400-$500 flights.

the quick tl;dr summary

First off, this is a long ass guide, and you should read it all because it lays it all out for you, but for you adhd, impatient, cut-to-the-chase folks, I’ll summarize for ya.

tl;dr: credit card points = free flights and it’s way more than you get with cash back cards. don’t rack up CC debt, obvi. I don’t churn (but do you, it’s a great strategy; I’ll cover it in a diff post). it’s a 3x or 3 step method to optimize points for flights – 1) optimize your cards & spend on those to get the most points, 2) utilize transfer bonuses to multiply those points, 3) utilize a site like seats.aero to find the cheapest flights and cross reference with Google Flights to make sure it’s a good trip to spend points on (3x your cash back otherwise just buy the cash flight; I usually like at least 5-10x my cash back rate). lastly, here are the 3 credit cards I use for points:

AMEX Platinum – 5x on flights/hotels; freebies (lounges, $200 uber credit, $200 flights, $200 entertainment/hulu, $200 hotel, etc.) to easily offset the $695 annual fee.

AMEX Gold – 4x on supermarkets/restaurants; $120 extra uber credit/year, $120 dining credit, $100 hotel credit, all the free insurance like platinum. $250 annual fee.

BILT Mastercard – 1 free ACH payment a month to pay your rent with no fees WHICH YOU GET POINTS FOR. 3x restaurants/lyft. points for rent is incredible. no fee!

last but not least, welcome bonuses. AMEX Plat does 120k-150k points when you spend 8k in 6mo. AMEX Gold does 60k-90k for 6k in 6mo. as of writing this, my AMEX plat link above has a 150k offer attached. to put it in perspective, I bought myself a 134k points + ~$150 First Class ticket (which would’ve been $16k+ cash); both from Chicago. I bought our $396 tickets in Japan the night before for 5.5k points each. These two redemptions are ~12x and ~8x the cash back value, respectively. yeah. this stuff is sick lol also appreciate the referrals if you use my links and most importantly — TRAVEL WITH ME!!

How I earn a ~$65k flight budget a year

I’ve been claiming something pretty bold this past year. Here it is:

Most people only fly 2-3 international trips and a few domestic trips a year.

If someone’s flying that little, they should spend almost nothing a year on travel.

Also, as a society, we should travel more.

In this detailed guide, I’ll walk you through how to earn, multiply, and use points.

Most importantly, I’ll teach you how to optimize all 3.

I’ll share the math and logic I use to earn about ~$65k in flight budget a year with points.

Maybe you spend more than me, maybe a little less; either way, you can have a really healthy flight budget.

All this without credit card churning (which I don’t currently do), although I think it’s an excellent method of earning points. I’ll call that level 2, this guide is level 1. If you want level 2, let me know and

Airline Status & Miles

What this guide is absolutely not about: Airline Status & Miles

How to accumulate miles or status with an airline:

Sign up for the airline reward programs, but manage your expectations accordingly.

Unless you travel a LOT (much more than me, honestly), you’ll probably just get your miles to pay for a free snack and some WiFi. I’ve gotten 1 single flight ever in my life time from miles and status is a far fetch’d pipe dream.

If you ask me, status is stupid for the average flyer, it’s not a value to people unless they travel for work (and work pays for a whole lotta overpriced flights with a premium airline). I do not recommend it.

If you fly frequently with one airline or if your work pays for flights, then pick a good airline (not one of the low cost ones) and you will get some additional free flights and upgrades from them. I am well on my way to booking my 2nd ever miles flight ever now and expect to by Q3 – 2024! This is not how I optimize my flying.

What I ask in return for sharing this guide with you:

Here’s what I’m asking you to do in return for this guide and information I’ve put together:

- Come adventure with me around the world! This is my #1 ask! I made this guide because I want my friends to travel with me more!! If we haven’t seen each other in a while, let’s reconnect & travel!

- Spread love & gratitude – travel brings me joy & I want others to be happy. If it makes you happy, be kind, be patient, and be generous with friends and strangers <3

- Use my referral links 🙂 It helps you and it helps me! However, if you have someone else you want to travel with, have them use yours, or use theirs! I get enough referrals and AMEX referrals are capped yearly.

- P.S. When I hit my AMEX referral cap I will update my links with my friend’s AMEX referral links so they can get points!

If you sign up for AMEX Plat (especially with my link), hit me up and I will share your link next! <3

- P.S. When I hit my AMEX referral cap I will update my links with my friend’s AMEX referral links so they can get points!

If you think that my statement and opening paragraphs are crazy but you’re curious, read on. I’ll start off by building my credibility for my claim.

Note: If you already know and trust me and what I’ll have to say in this guide, you can skip my chaotic travel itinerary, if you want.

Credentials & Credibility

I travel, a bunch. I spend very little.

If someone gives you travel advice and they only travel a couple of times a month or even less, should you believe them?

I’m terrible at posting on social but my IG/Snap/BeReal friends probably see me jumping to a different country every week or see my lil snap guy move around the globe.

If we’re IG/FB friends, I will be sharing more on there, I promise! I want more of my friends to start making use of points to travel so they can travel with me. This is the primary reason I’m writing this.

PSA: If you’re not a US Citizen/Resident (international friends, waddup), then unfortunately, the cards I mention will not apply to you, but my research shows that there are actually credit card options in Europe, Asia, and South America! I’ll add those someday soon, but in the meantime, everything else I talk about including the credit card strategy works for you, it just uses different cards! Read on and enjoy!

Over the last 6 weeks I was all over the U.S., and in Argentina, Brasil, Spain, France, Finland.

Alright, now, I’m gonna tell you a secret.

I did a fuck ton of Research. I am an optimization nerd, and not just in travel. I’ll have health and business blogs up sometime soon.

I paid for all my travel in cash my whole life up until 2024. I used cash back cards like everyone else foreverrrr and I got my first real travel card for points about 3 years ago, the AMEX Platinum, as soon as I understood enough to start collecting points. I did the perfectionist procrastination thing but I’m glad I started collecting (earning) points when I did. I didn’t start using my points until Dec 2023 so I could start traveling heavily in 2024. At this point I had accumulated hundreds of thousands of points (close to 1mm points!). Imagine if I started sooner? Anyway, nearly 3 years after that first card, I got my 2nd card, the Bilt Card, and now I recently got the AMEX Gold.

Why did I wait so long? Because I needed to do research. I kept accumulating and doing research to understand exactly what I needed to know. So many people use their points terribly and I didn’t want to waste them. I distilled the optimized path to using them pretty concisely here (yes, even though this is a long ass page), but I had to go and read blogs, watch countless YouTube videos, listen to webinars, podcasts, talk to folks, ask questions, and create my own path. I have a lot of friends that travel with points. I disagree with every single one of them so far (with love) on the best way to optimize points. I’m going to tell you my strategy, which is better, and bless you.

Note: Credit Card Churning. I don’t do churning right now, but I will sometime. It’s a better strategy than mine, honestly. I have plenty of points now and don’t need it but it’s a great way to get points and I’ll write about that in a future blog. This blog is level 1-3, churning is level 4.

Closing thoughts on blessing you with the gift of travel

Travel is a lot of fun, I genuinely feel thrilled that I can do this…without even spending much! If you tally’d what paying for the flights I’m taking, even for just a month of my travel could easily be over 10k just on flights (almost all of my travel is First/Business/Premium). Instead, I spend a few hundred a month on flights, paying basically just taxes. If I didn’t love doing First/Business Class for long haul flights I might only spend $150 a month on travel. Oh well.

P.S. Saving all this money means I can put that extra money towards other things. Maxing retirement investments, throwing charity events, following the silly tire guide for food, snagging VIP front and center Taylor Swift tickets in Spain (May 29), or following my favorite bands on Tour. P.S. Taylor was great, but Paramore was better, obviously.

Credit Card Points: The Travel Hack, Explained

Alright let’s start getting technical. Follow my guide below to start kicking ass at travel.

Travel Cards

- Which card to use

- Justifying the travel card

- How to optimize collecting points

- Which cards to use

- How to spend on each cards

- Bonus points

- How to optimize multiplying points

- How to optimize spending points

Which travel cards to use

First off, I’ll simplify this. I used to use cash back cards and I still have them, but they’re backups now. I effectively have 3 cards I’ll focus on here.

- Amex Platinum (the best credit card, pays for itself, no foreign transaction fees, unbelievable benefits, 5x on travel)

- Bilt (CC w/ no fee and you get points on your rent. Yep. like a checking account – you can literally venmo your landlord or send a check. 3x on restaurants, too)

- Amex Gold (a great credit card for grocery stores & restaurants)***

- Schwab (no monthly fee, no foreign ATM fees; use this to get the exact exchange rate on money, anywhere in the world)

All 4 cards have no foreign transaction fees, but I use AMEX/Bilt for international expenses and Schwab only for international ATM withdrawals (some places only take local currency). Please don’t ever use a debit card for a purchase again, or cash, unless you have to (cash only places are usually the cool ones, I know). Also, definitely don’t use a debit card internationally. Do you just like getting robbed and hate money? Thought so.

**AMEX Gold – I’m too lazy to write this out right now, but $250 annual fee, $120 uber credit a year (stacks with AMEX Plat), $120 dining benefit (limited), and $100 hotel benefit (limited). The bonuses kinda suck except Uber, but $130 to me is worth it for how much I get back on 4% groceries alone. I prefer 3% restaurant on Bilt to 4% on AMEX Gold, but more on that if you read on.

AMEX Platinum – The American Express Platinum Card

I’ll start with the card that I think all my friends should have, the Amex Platinum. It’s hard to justify not having this card. If your credit score sucks (<740) then you need to sort your shit, but otherwise, let me break it down for you

Justifying the AMEX Platinum

People get scared by the $695 fee and don’t do the math. You get benefits where AMEX just gives you the credit for things you probably already spend money on. Let’s do the math together and decide like calculated, rational adults.

$695 annual fee

Yearly Benefits (to offset the fee):

- $200 Entertainment credit (Hulu, Peacock, Disney+, ESPN+, etc.)

- $200 Uber credit (sorry Lyft, lol)

- $200 Flight credit (WiFi, snacks, seat upgrades, and certain bookings: e.g. award bookings qualify; more on this soon)

- $200 Hotel credits (Gotta book from AMEX’s collection and they’re bougie, but I like it)

- $189 Clear credit (let’s you skip the TSA Pre/Regular line & go right to the conveyor belt. I LOVE & can’t live without this)

- $100 Global Entry / TSA Pre Check* (Not annual b/c it lasts 5 years, but they give it to you for free)

- $100 Saks Fifth Avenue credits (I just buy gifts for other people with this; I value this at like $30-40 for me)

- Walmart+ / Paramount+ Subscription (Free grocery shipping…I shop at Wegmans/Whole Foods, but Paramount+ is nice!)

If you’re counting, the first 4 are $800 of cash back credits that are effortless to use ever year. If you live on a farm without Uber or a TV, then maybe you don’t fly much either and don’t need to fly for free. Let’s move on.

Wait, I gotta mention Clear ($189 value), which I now can’t live without. I originally thought it was a nice little perk, but honestly there are few things better in life than walking past a line that snakes around half a dozen times and going straight to the belt to throw your stuff on to get scanned. It’s like walking up to the club and you’re Barack Obama (I imagine, idk). Does he go to clubs? Does he even drink? I don’t, anyway. IDK. Let’s move on.

Now the intangible stuff:

- AMEX Centurion Lounge access

- I LOVE these lounges. Free GOOD hot food, free mid/top shelf drinks, I just had a delicious 3 plates of breakfast from the buffet and then took 2 shots of blueberry/strawberry/raspberry/orange smoothies they had in these big 3x shot glass shooters). Depending on the lounge you’ll find a different assortment of food/drinks (always food and drink) and then a mix of other great free stuff like free massages/facials at the spa (rare), shower (common), private rooms (common), and some have free table service (I prefer the buffet, it’s faster). The downside? You can’t bring friends (unless you spend 75k+/yr), but it’s a really nice little solo lounge oasis while traveling. Sometimes I run in for a smoothie shot even if I’m traveling with friends.

- Priority Pass & Travel Lounges

- AMEX Platinum gets you access to a ton of lounges and the Priority Pass lounge network, too.

- Free drinks (I’ve been to at least 100 lounges around the world, they’ve all had free mid-shelf drinks)

- Free WiFi (worth mentioning? I guess if you’re international without a data plan…I’ll add a guide for that soon)

- Free food (this is hit or miss…I’d say about 65% have hot food, 85% have some sort of food/snack; YMMV)

- Beds / Showers (I’d say about 15% have beds or couches, 25% showers – Minute Suites and others charge ~$20 for showers, many/most? are free)

- Downside: AMEX gives you the lounge network, not the restaurant network. This is available on Chase Sapphire Reserve ($550/year) that didn’t make my list, but would be #4, if I thought it was worth including them.

- Trip Delay/Cancellation & Baggage Insurance

- I haven’t had to use this yet but it’s really nice to have a free safety net on your travel! For example, you have $2k coverage on lost/damaged/stolen checked bags. If your trip is delayed 6+ hrs you can get up to $500 2x/yr (specific but reasonable, imho, terms apply), & up to $10k for trip cancellation/interruption for covered incidents.

- Phone Insurance

- $800 coverage for $50 deductible up to 2x a year…I’ve never lost or broke a phone…but I’ve dated people who dropped them in toilets frequently. Downside is you have to pay your cell phone bill with your credit card which loses you the ~$5-15/month discount for bank autopay. If you know there are phones on your plan that are “high risk” for damage/loss…this is probably worth it for you. Oh, and free points for paying your bill!

- Purchase, Warranty, & Return Protections

- Literally up to $10k if something you buy is lost/stolen/damaged, up to an extra year of warranty, if a US seller wont take an item back for up to 90 days AMEX will (up to $300)

- Occasional bonus point incentives

- They’ll occasionally offer you several thousand points for spending x amount of money in x timeframe. Usually it’s something I would spend anyway, it’s just a matter of seeing these bonuses which means opening the app occasionally and checking.

That was kinda annoying to write, it’s a bunch of stuff. I love having a card like this. I think it’s the best card on the market without question and I will be very upset when this mystical card goes away someday, somehow, because it is truly too good to be true.

Keep in mind, if people didn’t fall into credit card debt, AMEX wouldn’t profit enough to make this incredible value of a card available to us all. This is your warning. Pay your bill in full every month. If you calculate in the APR this or any credit card charges, the value of this card quickly goes the other way.

Bilt Card – The card to pay your rent with

Okay, this one’s pretty straightforward. This card has no annual fee. No foreign transaction fee, and it’s a Visa card so you have some variety when you’re traveling, in case somewhere doesn’t take AMEX (which is maybe 35% of places I’ve been to).

Most importantly though, you get points for paying your rent. Yep. No you don’t have to pay a fee or a % or anything.

Let me reiterate. YOU GET POINTS FOR PAYING YOUR RENT EVERY MONTH

It acts like a checking account. They give you an Act & Routing # and you can put it into Venmo or whatever service you use to pay your landlord. You can even have them send your landlord a check or you can do a direct bank transfer, if that’s what your landlord wants. They make it easy to pay your rent and you don’t pay any fees, you just get points for it, for free.

I’ll pause so you can re-read that and understand.

Yes, this is the only card that does this. Yes, I get nearly 3k points a month just from paying my rent. Yes, it’s that easy.

Some people literally think this is fake or a scheme when I tell them. Nope. Remember why this exists:

People fuck up and don’t pay their credit card bills and go into debt. It’s a TRILLION dollar industry that feeds on the poor and those who aren’t responsible, disciplined, or just get unlucky and shit happens.

Imagine doing that with a $3k rent payment on your card. It’ll accumulate QUICK and that APR will fund Bilt’s (Wells Fargo’s) shareholders plus the many benefits and points for the rest of us who use the card! Automate your bill to pay in full every month – don’t go into credit card debt. Equally as important, don’t be scared of debt. America runs on debt. Smart people use debt to their benefit.

Anyway, if the points for rent wasn’t reason enough, let me actually tell you the #1 reason why I absolutely LOVE this card and put it as my #2 of only 2 credit cards I use to get points.

They have insane transfer bonuses and end of the month bonuses. I haven’t covered transfer bonuses yet, but in short, they let you multiply your points with a transfer bonus and their most recent one was a 75%-150% multiplier bonus, based on how much you’ve spent. I didn’t really use it much before this so I was only silver status which got me 100% transfer bonus, but now I’m judiciously using it for dining and other 1x expenses instead of my AMEX Platinum so I can get to Gold! To put it in perspective, 100% transfer bonus meant that the 55k points I accumulated in the 5-6months I’ve had this card doubled to 110k points. The highest transfer bonus AMEX Platinum has that I’ve seen is 30% (which I used and LOVED), but this blows that away. If you lookup the highest airline partner transfer bonus in history, it’s 40% and it happened once. The norm is 10-30%, so 75-150% is unheard of and absolutely mind blowing. Imagine it doubling your travel budget, if that helps put it in perspective. Oh, and the other end of the month bonus perks are cool, the most recent one gave you a thousand points per card you linked to the Bilt portal (for shopping). You didn’t have to use the cards, just link them. Free points.

Cell phone insurance – $800 and a $25 deductible. Beats AMEX Platinum. Worth mentioning, but read the AMEX Platinum for more details on how I feel about this!

Okay one last pretty fun bonus. You get interest on your points! Silver status or above (which I have and was easy to get, I think it was 10k in spend/year) you start earning interest points on your points based on FDIC savings rate! This is pretty much nothing, but it’s kinda fucking cool.

They don’t specify if there’s a referral bonus on Bilt, but I do have a referal code that I get 2,500 points on per referral and of course I appreciate it if you want to use it. It’s not a lot of points, but free is free. Here’s my link: https://bilt.page/r/0TAI-PZ9N You may get 5x for 5 days on all purchases. Use it wisely!

How to optimize collecting points

First off, cards have multipliers. When I got my first travel card (AMEX Platinum) after a lot of research, I decided I would just collect points and not spend it until I had a good understanding on how to optimize multiplying and spending them. I would recommend the same to others. Start collecting as soon as you can! The card is worth it

AMEX Platinum – Optimize point collection

First of all, the welcome bonus. I didn’t mention it before because it’s just a one time thing, but you can get up to 150k points just for signing up. You can only do this once in your lifetime, but it’s incredible. Keep in mind, they do welcome offers of 90 or 120k. You can always get at least 120k from a referral, but occasionally (semi frequently) you can get 150k points from a referral or even just from a cold sign up. They also send welcome offers in the mail sometimes. As of now, you need to spend 8k in 6 months for your 150k welcome bonus. Don’t use cash at the bar, don’t use your debit card, don’t spend on other cash back cards until you hit this welcome bonus! I did it the first month, you can do it. It was 4k when I signed up and then went up to 6k, now it’s 8k. Act quick, you never know when it’ll go even higher.

Extra Bonus: Now through 5/22/2024 – you get +11 points per dollar spent on restaurants for first 3 months up to 25k spend. This is sick, I WISH I had this.

Full disclosure. It’s March 8, 2024. Right now I have a referral for 150k and I encourage you to use it because it does give me some points too. My goal with writing this content is really just to get my friends to be able to travel more so they can travel with me more! By making travel cheaper and more enjoyable (with lounges and business/first class award flights or upgrades) I expect to succeed in my mission in helping my friends travel more. If this helps you, I ask you to come join me for some travels. Literally shoot me a message and just let me know either where you wanna go or if you wanna join me on an adventure and we’ll travel and your company and our adventure is the biggest thank you and love I expect to get out of that. In lieu of that, or in addition to it, you can use my referral link to secure your 150k bonus sign up and it will get me 15-30k bonus points which is obviously nice – if you do this, please let me know <3. Sadly, I can only get 100k bonus points a year, but I haven’t hit it for 2024 yet! Here’s my link: https://americanexpress.com/en-us/referral/JAIMEUNGnF?XL=MNMNS

Alright, now the multipliers:

5x Travel – Book it directly with the airline to get this. You can book on AMEX Travel but sometimes those prices are more expensive and in general when you book with a third party you can run into issues with support, with oversold flights and getting forcibly bumped off, it’s not pleasant. Just do what the pros (me) do and book direct with the airline.

5x Hotels – If prepaid through AMEX Travel. This is fine. I usually book Airbnbs but occasionally book these. I just booked an ~$85 hotel in hong kong with 3 beds when I couldn’t find a good Airbnb for our group. 85×5=425 points. Nice. 5,000 points can be equivalent to as much as $800+ flight when choosing strategically, so I’m about ~1/10th of the way there with one purchase, or you could say I got ~$80+ of points value (not even including a transfer bonus yet!) from that one $85 purchase. That’s nearly a BOGO deal (Buy one Get One free) on a 5x expense. It’s pretty awesome, right? P.S. the Chicago ORD<>EGE Vail route I took before can be as much as $800+ and only 5k points

1x everything else. Listen, if I’m ever iffy on a purchase and want the purchase protections, I use my AMEX Platinum. Otherwise, I use my Bilt for 1x purchases because I think their transfer bonus will be bigger than AMEX’s. One caveat: If you just want to fly to Japan and in style, and don’t care about other flights, maybe use AMEX Platinum’s 1x and stick with Virgin’s 30% transfer bonus because they transfer to ANA on a great rate and ANA’s First Class and Business Class cabins are one of the greatest (if not the greatest) flight experience a human can have. The First Class one way ticket can be up to $27k by the way, and it’s so satisfying to get that with points.

Bilt Card – Optimize point collection

Let’s get right into it.

1x Rent – Pay your mother fucking rent on your Bilt card. If you have a roommate and they are willing to pay you to pay rent for both of you, DO IT. Otherwise, Pay your roommate or landlord for your half with Venmo or whatever and you can each get your part of the rent in points. By the way, you have to use your card for at least 5 transactions a month to get the rent points, which is easy. Automate it or just eat out a few times a month. I love eating out, so this is no problem for me :p

3x Restaurants – yum. This is what I use for Bilt. I think you can get more if you do Bilt specific restaurants but I don’t bother.

5x Lyft – This is nice because sometimes Lyft is cheaper than Uber and I I can feel good regardless of which one I use!

2x on Rent day (the 1st, typically) – This doubles your points. If you’re smart, you’d pay attention and go out to eat on the 1st or pay for big things that you’ll otherwise only get 1x on. I’ll be honest, I’m really strategic with certain things, but I usually just forget about this one. I’ve gotten a couple of good purchases in with this though, which is nice!

5x Welcome bonus for 5 days?? I got this when I joined, they didn’t tell me about it and it caught me off guard but it was a nice surprise. I luckily had a ~$3500 business expense I was able to put on this card and got ~17,500 points. This was sweeeet.

There are a few other bonuses. 10x on workout classes booked through Bilt. Things like that. I don’t use them, I have a gym at home, but if I did, 10x is amazing. They also do 2x on travel portal…but AMEX is 5x, so I don’t use it.

Quick breakdown of when to use which card

5x Flights – Use AMEX Platinum, book direct with airline

5x Hotels – Use AMEX Travel Portal, prepaid (not pay on arrival).

- If you book certain hotels, you get up to $300 credits, not covering that here

3x Dining – Use Bilt Card

2x Lyft – You can actually use any card in Lyft, it’s an award partnership, you just have to link your Bilt account

1x Rent – Use Bilt Card (and make sure you make 5 purchases a month on anything using your Bilt card to redeem the points!)

1x Any purchases – Use Bilt card (try to pay big purchases on the 1st of the month when you pay rent for 2x points)

How to optimize multiplying points

Look, this one is easy.

AMEX Platinum has a few transfer bonuses a year. Keep a look out, especially in July and December, which have historically been when the 30% Virgin transfer bonuses come up. It’s usually for a full month. That’s when I transfer my points, to Virgin. I transferred a few hundred thousand to Virgin in December and kept a few hundred thousand in my AMEX account just in case I need to book something with a different airline award partner.

Bilt Card is totally unpredictable. They’re a fairly new card so there’s not a lot of historical data to rely on yet, but my best guess from what I’ve seen is that they’ll give a few days warning before rent day (the 1st) and their transfer bonuses could be absolutely incredible. Keep in mind, their last one that I used was the best transfer bonus in the history of credit cards, by a long shot. I put 110k points into AirCanada AeroPlan then. They also have some transfer partners that AMEX doesn’t have, like American Airlines. I like diversification, because certain award flights are more points or less depending on the airline partner you use. This is why I have points across various accounts and partners. We could get into an inflation and net present value argument here, but with the deltas in multipliers and values, it blows inflation and NPV numbers out of the water and makes it a good strategy to diversify your point investments.

How to optimize using points

This is the 3rd and final piece of the Collect, Multiply, Use lesson. This one is unfortunately the hardest to put into paper and I’m going to run out of time with writing this so I’ll try to cover the key parts and iterate on it. I’m gonna go 80/20 here and get you the low hanging fruit of information that gets you the most value, but using points is a deep deep rabbit hole and I can’t share everything without more than doubling this already long post, so here goes nothing.

Important rule: Do not use your points for hotels, cash back, or anything other than flights in this way. You want the most value out of your points!

Use your points when the value is very high relative to what you would pay cash for it. There are 2 types of flights that frequently are very high value relative to the cash price of flights, and 1 bonus one that can be great.

- Short, Expensive Route Flights (e.g. Vail, Aspen, Jackson Hole, Westchester)

- Long Haul International Flights in Business/First (e.g. Japan! Singapore, Australia, Dubai, etc.)

- Busy/High Traffic Routes (e.g. NOLA for Mardi Gras, Tampa for Pride, Austin for SXSW)

Before I can talk about that, I need to talk about Award Flights, Award Partnerships, and Award Availability so you know what I’m talking about!

Award Flights, Award Partnerships, & Award Availability

Award Flights – These are flights booked with points! They’re pretty special. Basically you pay it in points and pay some taxes. The taxes can vary from something completely nominal like $5 to something that makes it not worth it, like $200. I pretty much won’t pay $200 for an award flight’s tax unless it’s a long haul first class flight (or at least business… and a really good point deal).

Award Partnerships – THIS IS IMPORTANT. When you transfer points to a transfer partner you can then use that award membership to book with any of their partner airlines! For example, I can book a United flight with AirCanada or Delta with Virgin, or United, or ANA. All the partners have a bunch of airline partners.

Note: When I say points, a lot of people think about the traditional miles that you accumulate from flying with an airline. These suck. You get so few for flying a bunch, or can pay a huge premium for more for them from the airline. Then you can use it on snacks and get pennies on the dollar, rarely a flight. No. Credit card points are flexible and let you transfer to tons of partners and then use that to book on a ton of airlines. Status with an airline is meh. I fly more than most (I think all) of my friends with status and I'm telling you it's a much better value to go with credit card points. Now, if you're booking with an airline, of course make an account and get miles from the booking too, it's extra, but don't expect to get nearly as much value from that compared to what I'm teaching here.

Award Availability – This is also important. Award bookings with points are a fluctuating market just like flight prices. Just like flight prices, there’s some predictability with them, too. For example, ANA tends to release award availability to Virgin for Business & First Class flights 10-11 days prior to the flight or 360+ days prior to a flight. This stresses some people out. I’m spontaneous so I love that it’s 10-11 days prior to the flight. Honestly, 3-4 days would be even better for me, but I think 10-11 is a sweet spot. Anyway, some are less predictable and ANA/Virgin also have some unpredictable awards that randomly come out. You need to set alerts for these or just search and see what you find some weekend and then fly somewhere spontaneous. That’s pretty much what I do every week and it’s incredible. I just go for the best deal where I can fly somewhere fun and internationally, usually, in Business or First Class, ideally.

Short, Expensive Route Flights

ORD (Chicago) <> EGE (Vail, Colorado) is an expensive ass flight. Why? because Vail is a tiny airport and “only rich people fly there”. Same with Aspen, Jackson Hole, and Westchester.

I mentioned it way above that the ORD<>EGE flight I took a few days ago was going for $800+. The points for this route was 5,000 points. That’s a $50 cash back value in points, but when used for a flight it’s 16x its value. The ORD<>DEN (Denver) flight was pretty damn expensive, too, by the way – nearly $400 each way. Painful.

My friends all had to drive 3+ hours to Denver on an avalanche route after 2 back to back blizzards with a high likelihood of road closure which turns it into a 6+ hour drive. It’s miserable. I wouldn’t wish that on anyone, especially my friends. But what can I do, I hadn’t made this post yet, but now it’s here and hopefully the next ski (snowboarding) trip most of my friends can fly direct with me! Depending on how much you pay on rent, this might be just 2 months of doing practically nothing but having a Bilt card and paying your rent like you normally would.

Long Haul International Flights in Business/First

Of course I’m going to talk about Japan here. I love Japan and anyone that knows me knows this. Funny enough I’ve never been to Japan and I’m saving it for (now very soon) when my mom finally retires. My retirement gift to her is to fly her First Class to go visit our best friends from my childhood, our neighbors who I grew up with and we were very close with.

Anyway, back to flights to Japan. ANA is one of the best airlines in the world, and Japan is known for its service. It’s always in the top 3, but I’d argue, from what I’ve seen and heard from YouTube videos and testimonials that it’s the #1 best airline experience in the world. Flying Business (The Room) or First Class (The Suite) is a marvelous experience that everyone of my friend deserves. I invite you to join me sometime after my mom retires this year. My Japanese is a bit rough but I’ve been practicing and I’ll show you an experience to remember forever.

Alright back to point redemption. An ANA flight from JFK or ORD can be as high as $27k+. I’m seeing one for the next weekend for $16,148 right now. I’m seeing that same flight for 134k points + $32.61 on Virgin. 134k = $1,340 cash value, for First Class, which means it’s ~12x+ value. A little less than Vail, but let’s look at the business class flight. Business class on ANA next weekend is 92k points + $32.61 for business class VS $12,790 cash. That’s $920 cash value for business class which means it’s a ~14x value. Nice 🙂

If you wanna spend less points, there’s an $8,086 United flight for 75k points + $50.94 through AirCanada’s AeroPlan that you could have transferred points to with Bilt. This one’s $750 cash value, or ~10x value, but it’s less points which is nice if you want to travel more and just want that lie flat comfort to Japan. Now let’s remember that you could have gotten a 100% or 150% transfer bonus, which means this could have cost you just 30k points on Bilt. That’s 10 months of rent for me but with the other points extras and bonuses it’s less, because remember, I got 55k points in ~5mo and I didn’t do a single referral bonus…this converted into 110k AeroPlan points.

Alright, let’s go up a level for a sec and throw some numbers together of what it could look like ideally, or at least what it looked like for me and then we can figure out the math of what it could look like for you based on how much you spend and optimize. Full disclosure, I spend a good amount so you may make less than me, but I could be wrong! Let’s see.

I made about 250k points on AMEX Platinum a year and trending for about 100k on Bilt a year. I expect this to change to 200k AMEX and 150k Bilt in the coming year. With the transfer bonus that’s 260k on Virgin and 300k on AeroPlan Canada, assuming the same circumstances repeat themselves (and I don’t hit a higher status on Bilt which would get me to 337.5k, but let’s forget that for now. 260k on Virgin is just about enough to buy 2 First Class flights on ANA so let’s round that one up. The 300k on AeroPlan Canada is enough to get 4 Business Class flights on ANA. Let’s calculate that math on how much that comes out to a year in value for flights. (2 x $16,148) + (4 x $8,086) = $64,640 wow. That’s more than I even spent on my AMEX Platinum (I wish I spent 75k in a year cuz then I could bring guests for free into AMEX’s Centurion Lounge again)! If we subtract the taxes I mentioned it’s still $64,371.02. I’m a nerd and I love seeing these numbers. Keep in mind, I’m trying to actively use my points on even better value stuff (like Vail!) when I can find it.

The bottom line is, if you had a ~$65k budget for flying this and every year from now on, or, conservatively assuming you spend less than me, even half that – ~32k budget for flights this and every year. Where are you going? Will you join me on some intercontinental adventures? Please do!

Alright, I’ve nerded out with numbers enough.

Busy/High Traffic Routes

I’m gonna leave this one for later because I need to wrap this up and there’s one big thing I still need to mention.

Where to search award availability

The final and most important part. Keep in mind, you’re not ready for this until you start really accumulating points, but knowledge is power and the sooner you learn this, the sooner you’ll be out there flying for next to nothing!

There are a bunch of websites where you search award availability just like you would search flight availability on Google Flights (also I hope you’re using Google Flights – it’s the best way to search for flights).

I love Seats.Aero – they’re free and you can make a free account. I pay for it and think it’s an incredible value. If you want a referral code: https://seats.aero/r/yyi1fbyj

roame is another one and there are a bunch of others you can find. I haven’t found something as good as Seats.Aero so I’ll stick to recommending them. You can set flight alerts (which is improving, but it’s helpful) and search award availability. Play around in there, it’s so much fun and so intuitive. When you find something good, click the little info button on the right to get a link directly to book it. Certain bookings need to be made via phone call, like Virgin/ANA bookings.

Closing Thoughts

That’s it my friend, I’ve taught you enough to take a big step towards being a traveler by starting to fly for next to nothing!

If this was helpful, please let me know! Share with friends who you want to travel with you. Use my referral links if you don’t have an AMEX Platinum or Bilt Card yet! Also, if you’re signing up for a free Seats.Aero account! Most importantly, LET’S TRAVEL TOGETHER!!!!!!

For AMEX Platinum, you should aim for 150k as your welcome bonus; if you really can’t get above 125k, if not contact me and I’ll find you a new link)

For AMEX Gold, you should aim for 90k welcome bonus.

BILT does not have a welcome bonus. Still an S Tier card!

Adios, friends; wishing you fun travels. If you have any questions, you know where to reach me

P.S. Follow my IG for updates or ask me anything: @jurteaga

P.P.S. Send me feedback please, this whole article is in Beta. I’m really just trying to share it with friends anyway, but maybe I’ll take it out to the public at some point. We’ll see. Anyway, I want it to be helpful so please let me know if anything is confusing or if you think I can improve something about it.

P.P.P.S. Love y’all <3

Europe/Asia/Australia/Non-US America friends – I don’t know how the CC points programs in other countries work yet, but I’m curious and learning! Hopefully there’s some overlap that’s helpful for you! I can book stuff in other countries which is nice 🙂

Next up… How to optimize your health to feel 15 again at 30 something. It’s fucking spectacular.